SUMMARY

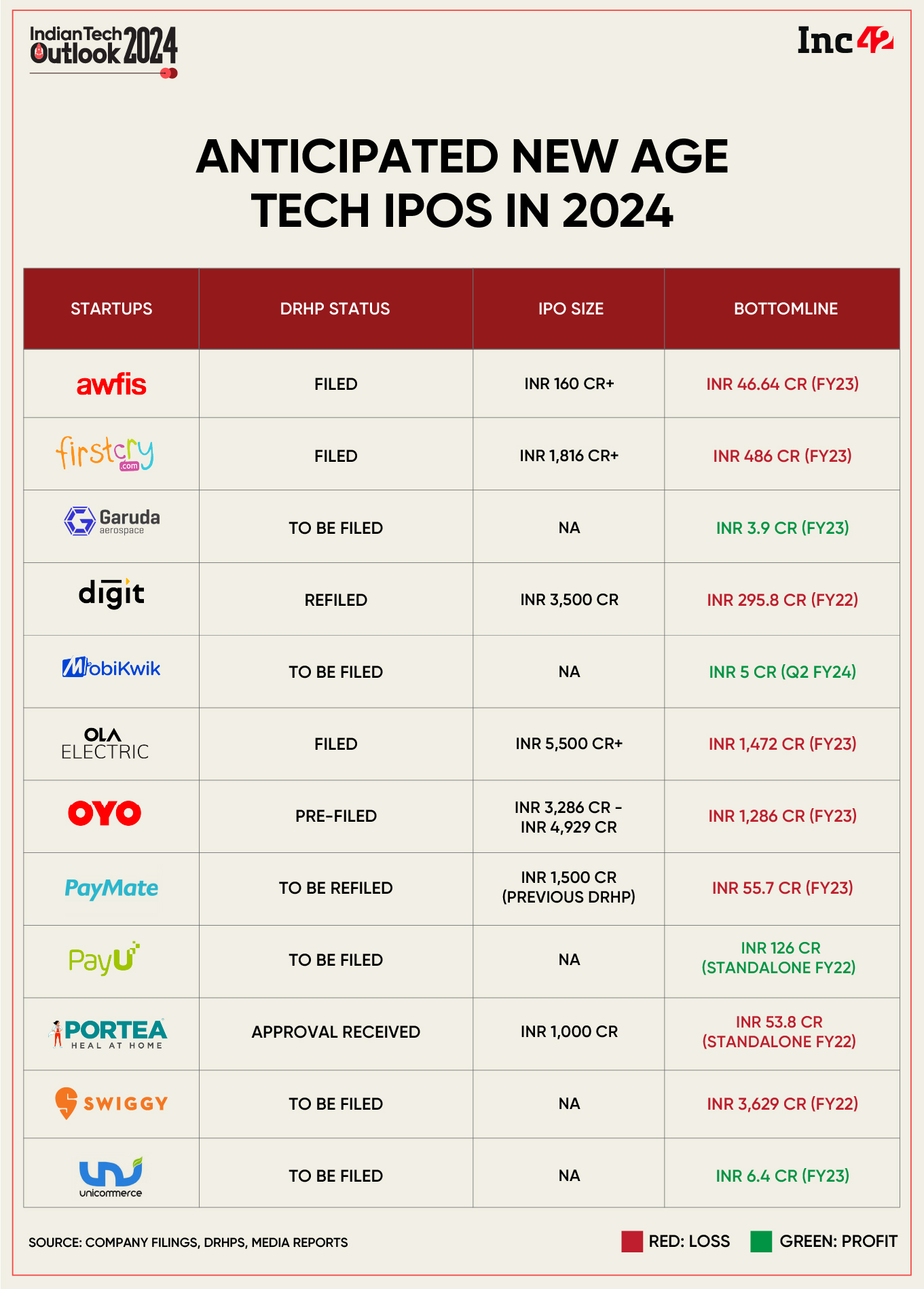

Experts believe that 2024 will see even more Indian companies taking the IPO route given that the benchmark indices, Sensex and Nifty50, are hovering around their all-time high levels

While the likes of Ola Electric, GoDigit, and OYO have filed their DRHPs, others like Swiggy, PayU, and Garuda Aerospace are also eyeing public listings next year

Inc42 expects at least 12 new-age tech startups to go public in 2024

After the global economic slowdown and high-interest rates brought an abrupt end to the initial public offering (IPO) party in 2022, the year 2023 saw some signs of revival in the public markets globally.

In India, the IPO landscape was abuzz with activities, especially in the second half of 2023, on the back of strong economic growth and positive domestic and foreign investor sentiments. Overall, the number of IPOs crossed the 100 mark by the start of December this year.

In line with this, new-age tech IPOs, too, picked up pace on the Indian stock exchanges. A total of five Indian new-age tech companies went public in 2023 as against a mere three in 2022.

The five new-age tech companies – ideaForge, Mamaearth, Yatra, Zaggle, and Yudiz – collectively raised over INR 3,600 Cr this year through their IPOs.

Experts believe that 2024 will see even more Indian companies taking the IPO route given that the benchmark indices, Sensex and Nifty50, are hovering around their all-time high levels. This is also expected to result in a surge in IPOs of new-age tech startups.

While the likes of Ola Electric, GoDigit, FirstCry and OYO have filed their draft red herring prospectus (DRHPs) with the Securities and Exchange Board of India (SEBI), others like Swiggy, PayU, and Garuda Aerospace are also eyeing public listings next year.

Then, there are also not-so-prominent names like Travel Boutique Online and agri-drone company AITMC Ventures, which filed their draft documents this year and are likely to launch their IPOs next year.

In addition, Mobikwik, Capillary Technologies and ixigo, which earlier postponed their plans of public listing due to adverse market conditions, may also decide to go public, considering the improvement in investor sentiment.

Considering the aforementioned factors, Inc42 expects at least 12 new-age tech startups to go public in 2024. With that said, here are the new-age tech companies that are likely to go public next year.

12 Startups Likely To Go Public In 2024

Awfis To Be India’s First Publicly Listed Coworking Startup

Chennai-based coworking space provider Awfis Space Solutions is set to launch its IPO in 2024 following its filing of its DRHP at the fag end of December.

As per the DRHP, the IPO comprises a fresh issue of INR 160 Cr and an offer-for-sale component of up to 1 Cr shares. With this, Awfis is set to become the first Indian coworking startup to go public.

The OFS component will comprise share sale of up to 5.01 Mn equity shares by Peak XV, up to 4.94 equity shares by Bisque Limited, and up to 75,174 equity shares by Link Investment Trust.

The startup plans to allocate INR 52.5 Cr from the net proceeds to establish new coworking setups. It aims to launch 15 new centres under the ‘Awfis’ format in FY25. These will span across Mumbai, Bengaluru, Delhi NCR, Hyderabad, Pune, Chennai, Kolkata, Ahmedabad, Lucknow, Bhubaneswar, and Jaipur.

The remaining net proceeds, amounting to INR 68 Cr, will be utilised as working capital.

Founded in 2015 by Amit Ramani, Awfis has evolved from a coworking network to a tech-enabled workspace solutions platform, catering to freelancers, startups, SMEs, large corporates, and MNCs.

Having secured $90 Mn from investors, Awfis completed its last funding round in May 2020.

The startup competes with the likes of WeWork, Smartworks, BHIVE, 91Springboard, OYO’s Innov8and Tablespace.

Awfis reported revenue of INR 545.28 Cr in FY23, compared to INR 257.05 Cr a year ago. Its net loss declined slightly to INR 46.64 Cr in FY23. In the first three months of FY24, the coworking space provider reported an operating revenue of INR 187.7 Cr, while its loss stood at INR 8.56 Cr.

FirstCry Wants To Be The Second New-Age Ecommerce Major To Go Public

FirstCry filed its DRHP with the market regulator SEBI in the last week of December. The Supam Maheshwari-led ecommerce unicorn is looking to raise INR 1,816 Cr through fresh issue of shares. With this, the startup is on track to become the second new-age vertical ecommerce major to go public after Nykaa.

The public issue also includes an OFS component of up to 5.4 Cr equity shares. Japan’s SoftBank, which owns over 25% stake in the startup, will offload 2 Cr shares, whereas Premji Invest will sell 86 Lakh shares during the OFS. Founder Supam Maheshwari will also sell some shares in the IPO.

The startup plans to use the net proceeds from the IPO for setting up new modern stores and warehouses, as well as lease payments for existing modern stores in India, totaling INR 648 Cr.

Additionally, it aims to use INR 155.6 Cr for investment in its subsidiary FirstCry Trading for overseas expansion in Saudi Arabia. It will also utilise INR 170.5 Cr from the IPO proceeds for investment in subsidiary Globalbees Brands to acquire an additional stake in indirect subsidiaries.

While INR 100 Cr will be used for sales and marketing initiatives, INR 57.6 Cr will be utilised for technology and data science costs. The remainder amount is intended to be used for funding inorganic growth through acquisitions, other strategic initiatives, and general corporate purposes.

Founded in 2010 by Maheshwari and Amitava Saha, FirstCry is an omnichannel baby and kids marketplace, providing various categories of products from clothing to essentials.

The startup entered the unicorn club in 2020 after raising $296 Mn from SoftBank’s Vision Fund.

It posted a consolidated net loss of INR 486 Cr in the fiscal year 2022-23 (FY23), a rise of 518% from INR 78.6 Cr in the preceding fiscal year.

Garuda Aerospace Expedites Listing Plans

Chennai-based drone startup Garuda Aerospace, which recently raised INR 25 Cr (about $3 Mn) in a bridge funding round led by Venture Catalysts and WeFounderCircle, is eyeing a listing around mid-2024.

In an interaction with Inc42 earlier this year, founder and CEO Agnishwar Jayaprakash revealed his IPO plans, expressing the hope to initiate proceedings post-March 31, 2024. However, the startup seems to have expedited its public listing plans since then.

Founded in 2015 by Jayaprakash, Garuda manufactures and sells drones, and offers drone-as-a-service (DaaS) solutions to sectors like agriculture, defence, mining, mapping, and warehouse management.

Earlier Jayaprakash stated, “We don’t want to be a startup with an inflated valuation because then it becomes difficult to maintain that and you just keep slipping. I want to climb the mountain. I feel that adding value and making a profitable business automatically will appeal to retail investors.”

Meanwhile, the Indian government is aiming to make India the drone hub of the world by 2030 and has implemented several reforms to foster the growth of drone manufacturing and usage within the nation. Consequently, two drone startups, DroneAcharya and ideaForge, have listed on the stock exchanges since 2022.

Currently valued at $250 Mn, Garuda Aerospace is looking to close FY23 with a revenue of INR 100 Cr. Speaking with Inc42, Jayaprakash had earlier said that the drone startup was eyeing a revenue of INR 1,000 Cr in FY24.

Go Digit Refiles IPO Papers

Even after refiling its DRHP, Insurtech major Go Digit General Insurance has yet to receive the final approval for its $440 Mn IPO.

The Bengaluru-based startup, which first filed its DRHP in August last year, refiled the IPO papers in March this year to address the concerns raised by SEBI about its employee stock appreciation plans.

Go Digit’s IPO comprises a fresh issue of shares worth INR 1,250 Cr and an offer for sale (OFS) of 109.45 Mn shares. The startup plans to deploy the proceeds to expand operations and increase its capital base.

After filing its first DRHP with the SEBI, the startup also received the IRDAI’s approval to launch the IPO in November, but the market regulator kept the IPO in ‘abeyance’.

In its new addendum of the draft prospectus, Go Digit General Insurance disclosed that it had received a show cause notice and multiple advisories from the insurance regulator.

Founded in 2017 by Kamesh Goyal, Go Digit offers insurance policies across verticals, including motor vehicle, health, travel, and property. Besides Prem Watsa’s Fairfax, the startup is also backed by prominent names such as Sequoia, cricketer Virat Kohli and actor Anushka Sharma.

In FY22, its loss widened 141% year-on-year (YoY) to INR 295.8 Cr. However, its operating revenue stood at INR 5,267.6 Cr in FY22 as against INR 3,243.4 Cr in the previous fiscal year.

Mobikwik Presses The IPO Restart Button

One Mobikwik Systems Ltd, the parent company of fintech unicorn Mobikwik, has restarted preparations for its $84 Mn (around 700 Cr) IPO.

According to a report, Mobikwik is working with DAM Capital Advisors Ltd and SBI Capital Markets Ltd to get listed.

The company is looking to go public next year.

It is pertinent to note that MobiKwik filed DRHP for its IPO of around INR 1,900 Cr with SEBI in 2021 – a year marked by numerous new-age tech companies going public. According to the draft documents, the IPO comprised an issue of new shares worth INR 1,500 Cr and an offer of sale (OFS) element of INR 400 Cr.

In the same year, the fintech major also bagged the SEBI nod for the IPO.

However, the company suspended the IPO process due to a downturn in the global equities market. In January 2022, the startup explicitly said that it would refrain from making a market debut until market conditions stabilised.

Meanwhile, Mobikwik claimed to have posted profit for the second consecutive quarter in Q2 FY24 with a PAT of INR 5 Cr.

Ola Electric Becomes First Indian EV Startup To File For IPO

Recently, Bhavish Aggarwal-led electric vehicle (EV) maker Ola Electric filed its DRHP with SEBI for an INR 5,500 Cr+ public listing.

As per the DRHP, the Ola Electric IPO will comprise a fresh issue of INR 5,500 Cr. It will also have an offer for sale (ODS) component of up to 9.5 Cr shares.

Cofounder and CEO Aggarwal and major investors, including SoftBank, Temasek, Tiger Global, Alpha Wave, Tekne Capital, and Matrix Partners, are set to participate in the OFS as Ola Electric prepares for its listing on the BSE and NSE.

According to the DRHP, the funds from the fresh issue will be directed towards capital expenditure for the Ola Gigafactory project, research and product development, organic growth initiatives, and general corporate purposes. Additionally, the proceeds will be allocated for the repayment or prepayment of the debt.

As per the draft document, the OEM’s net loss surged 1.87X to INR 1,472 Cr in the fiscal year ending March 2023 from INR 784.1 Cr in FY22.

The company also disclosed that its Q1 FY24 loss stood at INR 267.1 Cr.

Founded by Ola Cabs cofounder Bhavish Aggarwal, Ola Electric is an electric vehicle manufacturer, which currently has a lineup of five scooters.

At the end of October 2023, the company managed a comprehensive omnichannel distribution network, featuring 935 experience centres, which include 414 service centres.

In October this year, Ola Electric closed an INR 3,200 Cr ($384 Mn) funding round in a mix of equity and debt. While the equity part was led by Temasek, the debt part of the round was led by the State Bank of India.

OYO Slashes IPO Size To $400-$600 Mn

OYO filed its DRHP through a confidential pre-filing route and a reduced size in March this year, three months after SEBI directed the hospitality unicorn to refile its draft papers.

OYO initially filed its DRHP with the SEBI in 2021. At the time, it planned to raise INR 8,430 Cr ($1.2 Bn). However, the IPO size has now been scaled down to INR 3,286 Cr–INR 4,929 Cr ($400 Mn-$600 Mn).

Founded in 2012 by Ritesh Agarwal, the SoftBank-backed startup’s operating revenue grew 14% to INR 5,463.9 Cr in FY23 from INR 4,781.3 Cr in the previous fiscal year. It mainly earns revenue from sales of accommodation services, commission from bookings, and subscriptions.

Earlier this year, Agarwal told employees that the startup was on course to report its first ever profitable quarter in Q2 FY24, with a project profit of INR 16 Cr.

Lightbox-Backed PayMate To Refile DRHP With SEBI

Even after SEBI asked Mumbai-based B2B payments solutions provider PayMate India to refile its DRHP, the startup has yet to do so.

PayMate first filed its DRHP for an INR 1,500 Cr IPO in May 2022. It did not proceed with its IPO plans due to uncertain market conditions.

As per the IPO prospectus, Ajay Adiseshann, the founder of PayMate intended to sell a significant portion of his stake worth INR 134.73 Cr.

Founded in 2006 by Adiseshan, PayMate counts Visa, Lightbox and Recruit Strategic Partners as its investors.

PayMate’s consolidated net loss stood at INR 55.7 Cr in FY23, down a marginal 3.5% YoY. Its operating revenue rose 11.7% YoY to INR 1,350.1 Cr in FY23.

PayU India Eyes $500 Mn IPO

Prosus-backed fintech giant PayU India is looking to file its draft red herring prospectus (DRHP) with the market regulator in February for an IPO of at least $500 Mn. The IPO will likely value the company between $5 and $7 Bn.

The company is said to be aiming to go public by the end of 2024. It has enlisted Goldman Sachs, Morgan Stanley and Bank of America as IPO advisors. Further, it plans to involve at least one Indian investment bank in the transaction.

PayU claims to serve more than 4.5 Lakh merchants, over 70 large banks via Wibmo, and 2 Mn+ customers with credit facilities in India.

PayU India enables businesses to collect payments through over 150 modes, including debit cards, credit cards, net banking, BNPL, QR, UPI, EMIs, and wallets. It competes with Razorpay and Cashfree in India.

Its revenue surged 21% YoY to $497 Mn in the first half of FY24 from $412 Mn in H1 FY23, Prosus revealed in its half-yearly financial report.

Portea Medical Gets SEBI Nod For INR 1,000 Cr IPO

Earlier this year, Healthvista India, the parent company of the healthtech startup Portea Medical, received approval from SEBI for its IPO.

Portea filed its draft papers with the market regulator in July 2022, along with an addendum to its draft red herring prospectus (DRHP) on March 10, 2023.

The IPO will comprise a fresh issue of equity shares worth INR 200 Cr and an offer for sale (OFS) of up to 5.62 Cr shares worth INR 800 Cr.

The OFS will see Accel sell up to 2.48 Cr shares that it holds across Accel Growth III Holdings (Mauritius) Limited, Accel India III (Mauritius) Limited and Accel India V (Mauritius) Limited. Ventureast Life Fund III will sell up to 42.78 Lakh shares, and MEMG CDC Ventures will sell up to 44.45 Lakh equity shares.

Qualcomm Asia Pacific will be selling up to 42.56 Lakh equity shares and Sabre Partners Trust will offload up to 39.84 Lakh equity shares in the OFS.

Healthvista India plans to use the incoming funds for its subsidiary’s working capital requirements, debt repayment, medical equipment purchase, inorganic growth, marketing, and general corporate needs.

Founded in 2013 by Krishnan Ganesh and his wife Meena, Portea offers healthcare services, which include maternal care, physiotherapy, nursing, lab tests, counselling, and critical care.

Portea is currently operational in 16 cities across India. In FY22, the healthtech startup posted a net standalone loss of INR 53.82 Cr against revenues of INR 96.37 Cr.

Swiggy Set To Float The Biggest Startup IPO Of 2024

In what is being called the biggest IPO by an internet company next year, food delivery giant Swiggy will likely list on the stock exchanges in mid-2024 with an issue size of $1 Bn (INR 8,300 Cr).

As per market analysts, one of the major things to watch out for will be Swiggy’s valuation, which has seen various markdowns and markups.

Swiggy initiated IPO preparations last year, initially eyeing a 2023 listing. However, global tech startup valuations experienced a sharp decline, causing Swiggy to temporarily defer its plans.

Founded in 2014 by Sriharsha Majety, Nandan Reddy, Phani Kishan Addepalli, and Rahul Jaimini, Swiggy has raised $3.6 Bn to date.

Swiggy’s net loss jumped 2.2X to INR 3,628.9 Cr in FY22 from INR 1,616.9 Cr in FY21 on the back of a sharp rise in expenses.

Unicommerce Sets Sight On A 2024 Listing

Unicommerce eSolutions Pvt Ltd, which offers a software-as-a-service (SaaS)-based order management and fulfilment platform to ecommerce and retail businesses, is expected to make a public listing late next year. The cofounder of Snapdeal, Kunal Bahl, mentioned about the Unicommerce IPO in an X post on November 7.

The startup enables end-to-end management of ecommerce operations for D2C brands, retail companies, and other online sellers through its comprehensive suite of SaaS-based technology products.

Unicommerce’s platform keeps track of stocks across multiple warehouses, keeps inventory information updated across multiple sales channels (both offline & online) and automates order pickups to support faster and more accurate deliveries.

Unicommerce’s operating revenue zoomed 52% to INR 90 Cr in FY23 from INR 59 Cr in FY22 due to a strong demand for its services.

Snapdeal acquired Unicommerce in 2015. Established in 2012 by IIT Delhi alumni — Ankit Pruthi, Karun Singla, and Vibhu Garg — the founders exited the company within two years.

[Edited by Vinaykumar Rai]