SUMMARY

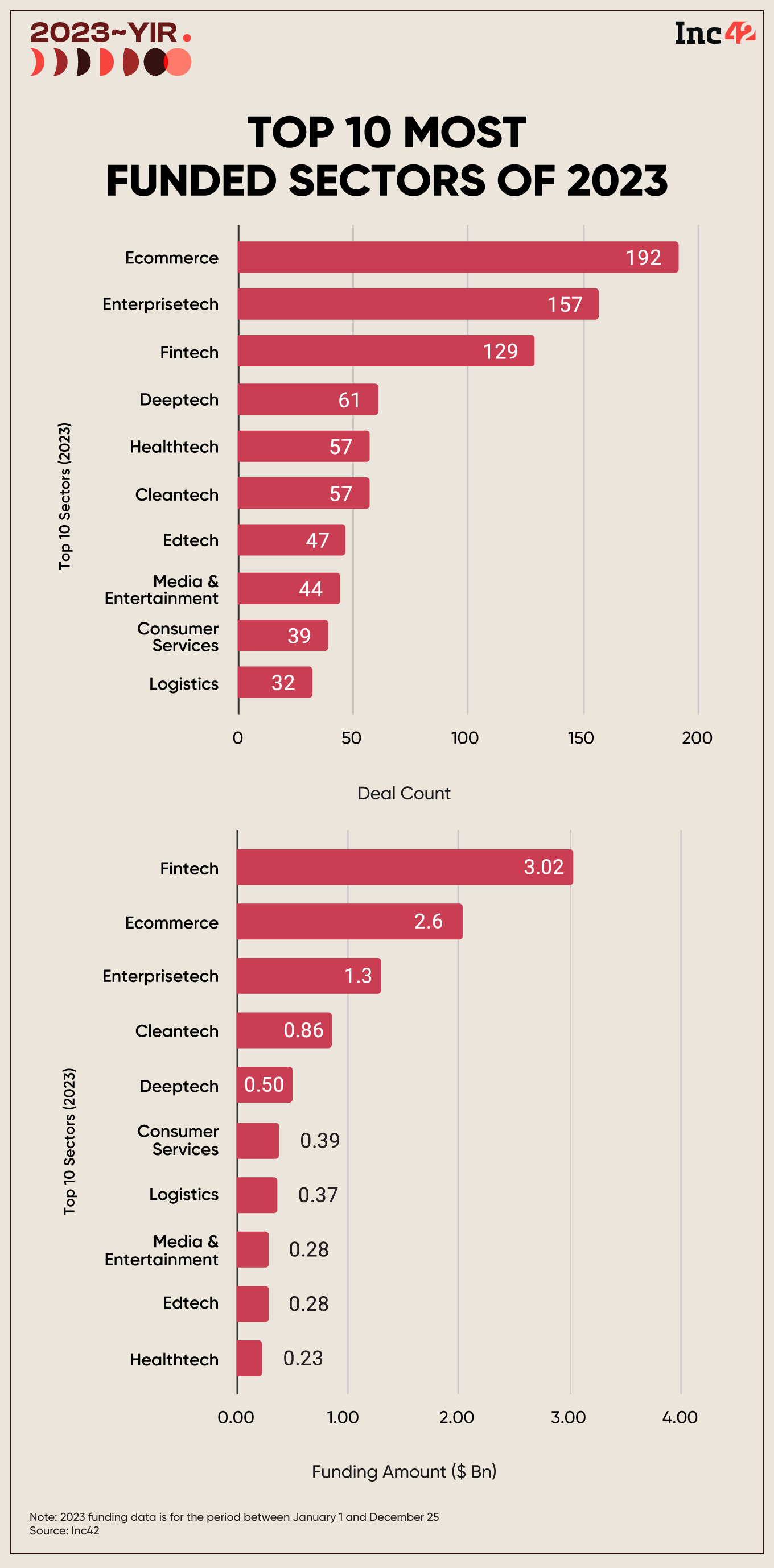

According to Inc42, fintech, ecommerce and enterprise tech sectors accounted for more than two-thirds of the total funding raised by Indian startups in 2023

Deeptech emerged as the dark horse of the year that was otherwise infested with dying investor trust as funding was up 50% YoY

Sectors like edtech, media and entertainment, and consumer services also saw a severe year-on-year funding decline in 2023

Standing on the precipice of 2023, we took note of some of the most concerning funding trends in the world’s third-largest startup ecosystem.

According to Inc42’s annual ‘Indian Tech Startup Funding Report 2023’, Indian startups secured just over $10 Bn in funding until December 25 this year, down 60% compared to the $25 Bn raised in 2022.

Not just this, deal count, too, withered 40% YoY to 897 as the investor appetite waned due to several startup misadventures during the year. Historically, Indian tech startup funding hit a seven-year low, plummeting even below the $13 Bn raised in 2019.

However, despite the massive shortfall, the likes of fintech, ecommerce and enterprise tech continued to lead the funding scenario in the Indian startup ecosystem.

According to Inc42, these three sectors accounted for more than two-third of the total funding raised by Indian startups in 2023. Interestingly, the sectors also contributed to more than half of all startup funding deals that took place in the homegrown startup ecosystem in 2023.

As the three sectors continued to dominate the startup food chain in the country, let us take a look at what the funding scenario looked like in different sectors in 2023.

Fintech: The Shining Jewel in India’s Startup Crown

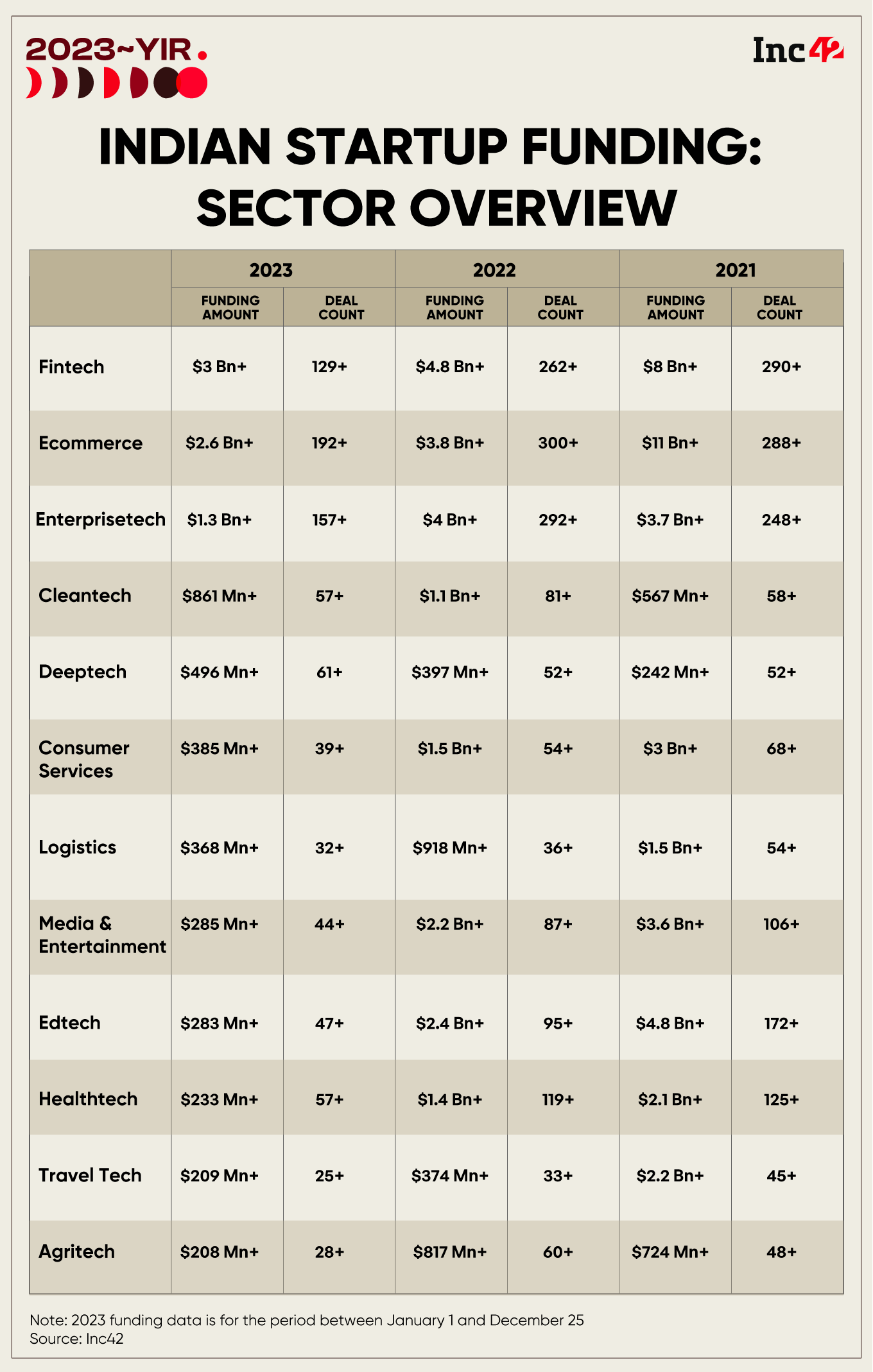

In 2023, as many as 129 fintech startups cumulatively raised $3.02 Bn, according to Indian Tech Startup Funding Report 2023.

Even though the figure was down 37% compared to the $4.8 Bn raised a year ago, fintech remained the shining jewel in India’s startup crown as the most funded sector.

In the fintech realm, lending tech was the top choice of investors, as nearly 40% of all fintech funding ($1.2 Bn) went to lending tech startups. Subsectors like banking and fintech SaaS bagged $971 Mn and $348 Mn, respectively, during the year.

Looking at stagewise funding, early stage fintech startups saw the worst year-on-year decline in funding at 54%. Meanwhile, growth and late stage startups also saw a funding meltdown of 33% and 36%, respectively.

Ecommerce Held Its Ground

Given India’s rapidly rising population of online shoppers, it is no surprise that ecommerce remains one of the top-funded startup sectors. However, investors’ second-most favourite sector, too, could not escape the chills of the funding winter.

Until December 25, 2023, as many as 192 ecommerce startups ended up securing $2.6 Bn in funding in 2023, down 32% YoY compared to $3.2 Bn in 2022. The three subsectors within the ecommerce realm that took the most sectoral funding were D2C, B2C and B2B. Meanwhile, D2C startups attracted $1.4 Bn in 2023.

In terms of stagewise funding split, seed stage startups suffered greatly and could only raise around $89 Mn in 2023, down 65% YoY.

Enterprise Tech Takes A Deep Plunge Over The Years

As the Indian startup ecosystem moves towards correction, businesses across sectors, from manufacturing to finance, are increasingly relying on tech solutions for automation, efficiency, and growth. This has created a steady (and unsurprising) demand for enterprise tech products and services.

This made the sector the third most funded sector in India’s vibrant startup ecosystem. Yet, the enterprise tech space witnessed a significant jolt in 2023, as more than 150 startups raised a mere $1.3 Bn compared to a whopping $4 Bn in 2022 and $3.7 Bn in 2021.

Several factors conspired to temper investors’ enthusiasm for this space. The global economic slowdown cast a shadow, raising concerns about return on investment and prompting VCs to tighten their purse strings.

Deeptech Flourished As The Dark Horse In 2023

On the contrary, deeptech emerged as the dark horse of the year that was otherwise infested with dying investor trust.

The sector raised $496 Mn in 60+ deals, mirroring a rise of 50% from $397 Mn raised in 2022 and a 105% increase from $242 Mn raised in 2021.

As AI became an inevitable part of daily consumption habits in 2023, VCs and PEs started attaching their investments to startups disrupting established industries and solving complex problems.

Furthermore, the Indian government’s push for indigenous technology development created fertile ground for Deeptech startups to flourish. Initiatives like the National Mission on Quantum Technologies, the draft deeptech policy, Atal Innovation Mission, and the Prime Minister’s Science, Technology and Innovation Advisory Council (PM-STIAC) are further set to provide crucial support in this arena.

Beyond AI, other deeptech sub-sectors like robotics, biotechnology, and materials science are also expected to see significant traction going ahead.

The potential for these technologies to revolutionise industries and improve lives is drawing increasing attention, attracting both domestic and international investors. Yet, the sector has its challenges. Long development timelines, high investment requirements, and the absence of a quality talent pool cannot be ignored.

Despite the roadblocks, the sector is well poised to play a pivotal role in India’s economic growth.

Other Key Sectors On The Tenterhooks, Too

While the Indian startup economy maintained its momentum, specific sectors found themselves in the passenger seat despite being in the top 10 checklist of investors.

Edtech, once the poster child of startups, faced a harsh reality check in the year of the extended funding winter. Layoffs created sombre headlines as demand crumbled. Parents, previously enthusiastic about filling every learning gap with online courses, tightened their belts amid economic uncertainty.

The initial frenzy subsided, leaving many startups scrambling for viable business models. Amid all this, investors infused only $283 Mn into fewer than 50 startups. This capital infusion into the sector was down 88% YoY and more than 94% from 2021.

Similarly, the media and entertainment space was also impacted significantly — falling from $3.8 Bn+ raised in 2021 to a mere $285 Mn raised in 2023.

Moving on, consumer services, a sector catering to several needs, felt the pinch of consolidation. Dominating players captured an outsized share of the market, squeezing smaller providers. Demand congregated in specific subsectors, leaving others neglected.

Unfortunately, the sector witnessed a 90% decline in funding from $3 Bn+ raised in 2021 to $385 Mn in 2023.

Download The ReportStartup Funding — Outlook For 2024

Overall, the dip in the funding of the Indian startup ecosystem shouldn’t be misconstrued as a decline, experts suggest. The current slowdown is being viewed as a necessary correction and a sign of maturing growth. The initial exuberance has given way to a more measured approach, where investors favour proven business models and sustainable traction over speculative leaps.

Moreover, startup fundamentals have only started to get stronger. While the year proved to be a litmus test for many Indian startups, it also nudged the erring players to focus on the right set of metrics, rooted in hard facts and beyond vanity metrics.

Even though startup funding levels are at their seven-year low, experts believe this is only a temporary setback, which could pave the way for a more resilient and thriving startup landscape. Meanwhile, notwithstanding the funding chill of the past two years, the ecosystem has much to look forward to in 2024.

[Edited by Shishir Parasher]

Download The Report