SUMMARY

D2C players or ONDC will have some impact in 2024 but the likes of Meesho, JioMart, and TataNeu are in a position to challenge the duopoly of Amazon India and Walmart-owned Flipkart

The government has lent its support to the ONDC to check the dominance of large players and its focus in 2024 will be expansion into many cities, and vertical expansion

Omnichannel strategies will become even more essential for the success of D2C players, even as the house-of-brands model is expected to face severe challenges in 2024

India’s $100 Bn+ ecommerce market has seen a slew of changes in 2023, ranging from the entry of new players, the expansion of the Open Network for Digital Commerce (ONDC) going live and D2C brands exploring the omnichannel path for revenue growth.

While Walmart’s infusion of $600 Mn into Flipkart as a part of its mega $1 Bn round hogged the limelight towards the end of the year, Amazon put a pause on its spending in India and streamlined its workforce in line with global strategy.

The past year also saw MamaEarth, become the first publicly-traded D2C brand in India, with IPO subscribed 7.6 times amid a spiked interest from the institutional investors.

India’s two largest conglomerates, Reliance Industries and Tata Group, are also rewriting their playbooks to grab a major chunk of the burgeoning online retail industry, with the focus now shifting to clock revenues from beyond metros and Tier 1 cities.

At the same time, the government has lent its support to the ONDC to check the dominance of large players in the aggressively growing ecommerce market. The year 2024 promises to bring many of these factors into play.

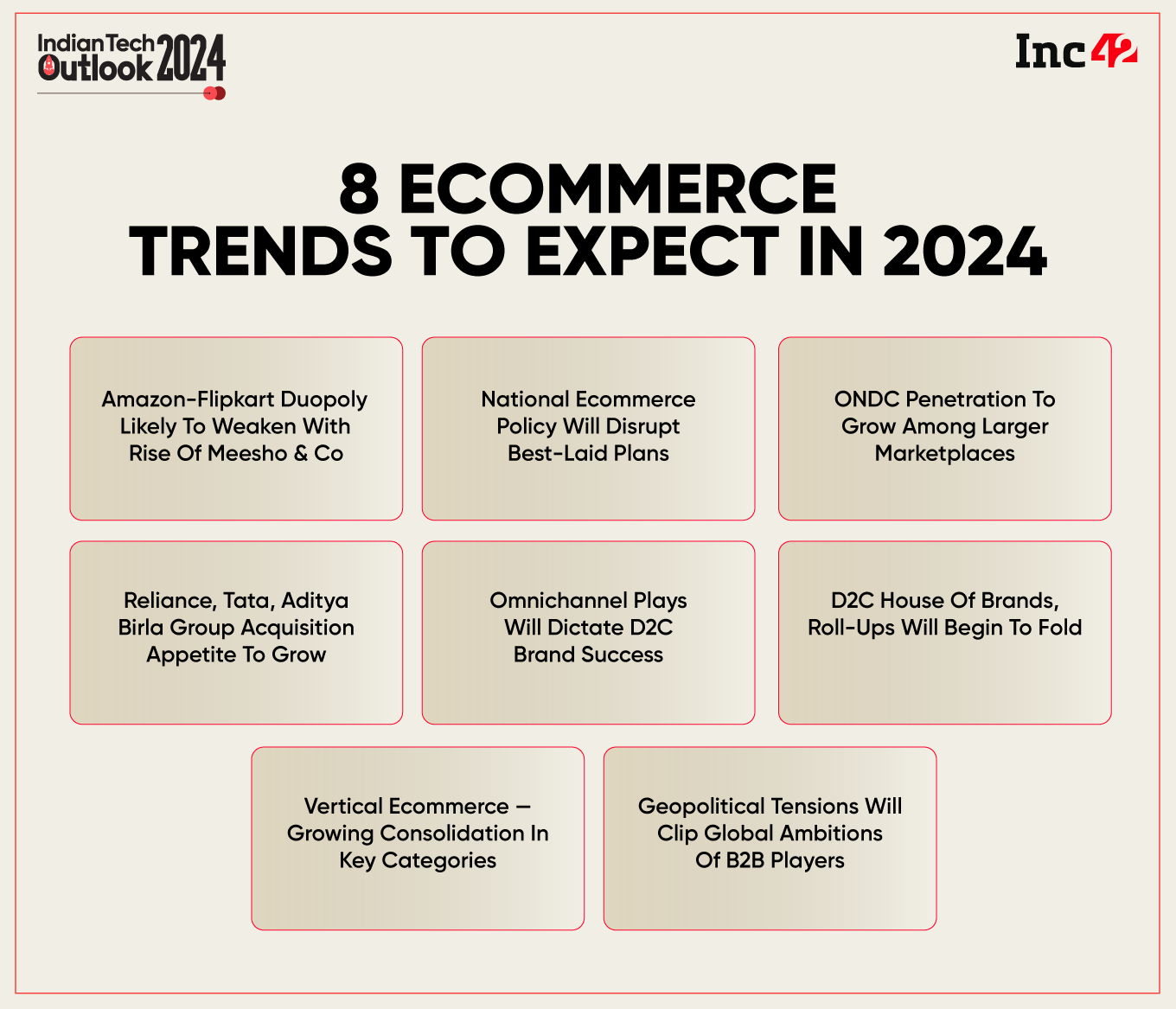

The 8 Biggest Ecommerce Trends To Expect In 2024

Amazon-Flipkart Duopoly Likely To Weaken With Rise Of Meesho & Co

Despite a challenging regulatory environment, the strengthening of the D2C ecosystem and ONDC’s foray into digital commerce, marketplace giants Amazon India and Walmart-owned Flipkart have managed to capture more than 90% of the total gross merchandise value (GMV) during the peak festive sales in 2023.

Even as these giants are building strategies to operate in a far more regulated environment than before, analysts believe that the marketplaces will continue to leverage the first-mover advantage, scale in terms of user base, and distribution channels in 2024, giving them an edge over the competition.

Except for SoftBank-backed Meesho, which has made surprising leaps in terms of average month-on-month user growth, analysts predict other players will not dent the current ecommerce revenue share of Amazon and Flipkart.

D2C players or ONDC will have some impact in 2024, but only Meesho is in the position to challenge the duopoly. In April 2023, equity research firm Jefferies said that Meesho is growing faster than the overall growth rate of the ecommerce industry in India.

“Meesho had an impressive 120 Mn average monthly active users on its platform during CY22. Over the last two years, Meesho added ~100 Mn MAUs, much higher than additions by peers. Meesho scores well on all stages of an online purchase journey, including awareness (measured by app downloads), consideration (measured by MAUs) and transaction (measured by MTUs),” the Jeffries report added.

Other analysts believe Meesho’s zero commission model for sellers who offer unbranded products targeted at consumers from middle-low income households has worked for the Bengaluru-based ecommerce unicorn which has captured 7% of the ecommerce market share in India.

However, the larger question is how these giants will move beyond Tier 1 cities and metros, which have driven a majority of the revenues so far. Meesho and even the likes of JioMaart or TataNeu will have to capture underpenetrated markets, a top ecommerce industry analyst told us.

“This is especially true since Amazon and Flipkart do have control over large inventories earlier in the form of companies like Cloudtail, Appario and now private label brands. With time, if the regulators do not put an end to this structure through definitive laws, Amazon and Flipkart will build on the market duopoly,” an ecommerce analyst added.

National Ecommerce Policy Will Disrupt Best-Laid Plans

The year ahead is also expected to see the announcement and implementation of the much-awaited ecommerce policy after years of battles between India’s retailer body, the Confederation of All India Traders (CAIT) and the marketplace duopoly.

Sources told us that the announcement of the ecommerce policy was deferred since both Amazon and Flipkart have had several rounds of discussion with the Union Commerce Ministry expressing contentions over the various provisions of ecommerce consumer protection rules (2020).

Sources told us the policy builds on the ecommerce consumer protection rules (2020) and will incorporate strict adherence to local data storage, consumer interest, the counterfeit policy of marketplaces, marketplace linkages and ownership of sellers, predatory pricing, forced discounting and flash sales.

The ecommerce policy, as per several reports, will not see further revisions or drafts made publicly.

Amazon and Flipkart are particularly in a tight spot since they are owned by foreign entities and have been alleged to have violated FDI and FEMA rules in past. As such, the upcoming ecommerce policy is expected to impact them the most, especially since both have aggressively expanded in having partnerships and tie-ups with private-label brands over the past few years.

There have also been allegations of both using the data of the most popular products being sold on the platform to build their private labels. “It will be interesting to see what the regulations hold in place for advertising on ecommerce marketplaces since that is where Flipkart and Amazon draw a majority of their revenues now,” Prem Bhatia, CEO of ecommerce tech company Graas, told Inc42.

ONDC Penetration To Grow

ONDC made a big foray into India’s digital commerce sector in 2023, the first of its kind initiative in the world to transform the digital trade and ecommerce landscape. Although ONDC began by disrupting food delivery, the fact remains that the open protocol is yet at a very nascent stage.

ONDC is still building its network and hence would need aggressive seller onboarding, awareness campaigns and investment in marketing to make a dent in the online retail industry as it is.

CBO Shireesh Joshi told Inc42 that in 2024, ONDC’s focus will be further expansion into cities and vertical expansion.

“We are focussed on expanding our services to many cities with a wider range of products and services. A case in point will be for instance we are devising this product of sachet loan products for street side vendors at a very low interest rate against their sales history. The target is becoming accessible and penetrating to remote markets,” he added.

Notably large players such as Snapdeal, Amazon’s logistics arm Amazon Transportation Services (ATS), BigBasket, PhonePe, Paytm, and Ola have joined the network, showing the network’s growing presence and stature.

ONDC will continue to function as a not-for-profit entity and may eventually charge small fees from sellers but that will happen several years down the line. On the discount/incentive side, the ONDC CBO maintained that the buyers may expect some discounts slashing around Q1 2024.

Sources have informed us that the big ecommerce players have largely stayed away from ONDC which again puts a question on the scalability of the open protocol. “That is a larger question which should be posed to Amazon and Flipkart,” Joshi said in response.

Reliance, Tata’s Acquisition Appetite To Grow

Despite the ecommerce industry’s explosive growth over the past few years, the $100 Bn+ industry is still very small compared to the $1.5 Tn retail industry which is where the biggest conglomerates of India like Reliance Industries, Tata Group, and Aditya Birla Group have a huge edge over the ecommerce players.

Reliance and Tata have unshakeable dominance in the retail industry of India on top of which they have built JioMart, TataNeu as well as other platforms.

Industry sources revealed that the next leg of growth for these conglomerates will come from digitising their thousands of offline stores, bringing their brands into the digital sphere and acquisitions.

“In a way, Tatas and Reliance will have different playbooks. Reliance eyes acquisitions and distress deals to strengthen its presence in any industry. We may expect Reliance’s Jio to acquire more brands across fashion, grocery, pharmaceuticals, and apparel, verticals. For Tatas, their loyalty programmes, super app ambitions and infusion of capital to build a good tech stack, expand to multiple categories would be priorities,” an industry analyst said.

While Amazon and Flipkart’s dominance has been in online retail across selected markets, Reliance and Tata are bringing in organised retail models which will be integrated with their digital presence.

Omnichannel Plays Will Dictate D2C Brand Success

Is the party over for the D2C ecosystem? Mostly, Yes.

The D2C brands were cashing on the lower interest rates globally as a result of which the VC money aided the quick expansion of the digital-first brands. However post-pandemic, a realisation has dawned upon the D2C startups that they will have to build an omnichannel strategy to cater to offline markets and still depend on third-party marketplaces to sell online.

“In future, omnichannel strategies will become even more essential for the success of D2C brands. For a seamless customer experience, brands need to integrate online and offline channels as new technologies continue to redefine consumer interactions,” Ashish Dhuwan, Vice President, beatXP, an online store for health products said.

Personalised experiences across channels will be provided through data-driven insights, making personalisation essential. New technologies, such as artificial intelligence (AI) and augmented reality (AR), will further enhance the omnichannel play of D2C brands.

Success in the D2C is accelerated by omnichannel integration, which simplifies and streamlines the customer experience across multiple platforms. Online platforms, social media, and retail stores are just a few of the channels that D2C brands can integrate to create an easily accessible customer journey, he further said.

Graas’ Bhatia said that the D2C brands will have to cut down on their marketing, and advertising spending in 2024 while adopting a wait-and-watch strategy for capital to flow into the markets before they go into expansion mode.

“In general, I don’t think that the first few months of 2024 will be an easy market for D2C brands. On the positive side, some of the Indian D2C brands which have good products can explore Southeast Asia, the Middle East and other geographies as markets,” Bhatia added.

D2C House Of Brands, Roll-Ups Will Begin To Fold

Amazon brands aggregator Thrasio’s meteoric rise and fall perhaps now serves a lesson or two for many of its clones in India.

The ‘house of brands’ ecosystem in India that mushroomed in the past few years has more or less subsided. The likes of Mensa Brands, Goat Brand Labs, Upscalio, and Globalbees raised millions of dollars in quick succession, going on an acquisition spree.

But industry players believe these acquisitions happened at fairly high valuations, and the fact that many ‘house of brand’ platforms raised venture debt, means they now find themselves in a difficult spot when it comes to long-term survival.

“Even the large fundraise for house of brands involved a heavy debt component and now the cost of the repayments has increased which has impacted their growth prospects,” an industry insider said.

The year ahead will see further consolidation and mergers in this space with the likes of Aditya Birla-backed TMRW, Wipro Consumer Care or even Reliance acquiring a few such startups.

“Even if the distressed sales happen in the first half of 2024, as soon as the interest rates lower globally and VC money flows, we can expect some of the roll-ups to raise capital again but till then it will be a matter of withstanding challenges,” the founder of a Bengaluru-based D2C brand said.

Vertical Ecommerce In For Consolidation

Category-specific ecommerce marketplaces or vertical marketplaces have made significant strides over the past couple of years with the likes of publicly listed companies like Nykaa and CarTrade even achieving profitability, while Urban Ladder attracted Reliance’s eye.

This is at a time when horizontal marketplaces like Amazon and Flipkart are yet to reach profitability despite a majority share in the industry.

The upcoming FirstCry IPO will serve as an important metric for the success of vertical ecommerce marketplaces in 2024 as per analysts.

Nykaa, Cartrade or FirstCry will set the benchmarks for vertical ecommerce in the country. Since these are publicly listed companies the focus will also be laser-sharp on achieving and maintaining good unit economics, a market analyst said.

We have also seen Reliance acquiring Netmeds, Urban Ladder, and Tata acquiring 1MG, and CaratLane in the past few years.

Experts are also expecting privately held vertical ecommerce marketplaces will land more funding and acquisition opportunities in 2024, given the success of category-specific market leaders.

How Will B2B Marketplaces Fare?

While most of the focus in ecommerce is on marketplaces, B2B ecommerce has grown tremendously in the past half-decade. However, market analysts expect their growth to be dependent on capital access given the cost of acquisitions of materials and maintenance of warehouses is capital intensive.

Even as B2B unicorn Udaan announced a mega fundraise, the reports mentioned that it was a mix of equity and debt which was a down round. Udaan’s revenues have also fallen considerably in FY23 even as it looked to pare down costs.

The smaller B2B ecommerce marketplaces are now challenged with reducing the acquisition/ purchase costs of raw materials and finding buyers who they can sell at a reasonable price.

“Essentially the discount party that the B2B marketplaces had to offer to buyers is over. And now, we will only see the market leaders surviving the storm,” an agritech marketplace founder said.

In addition, exploring markets beyond India may prove to be more difficult given the geopolitical tensions in the Middle East, Russia and the US.

“The B2B marketplaces will have to reduce their dependencies on asset-heavy models and focus on India as a geography in 2024 to become cost-effective and generate revenue,” the founder quoted above said.

[Edited By Nikhil Subramaniam]