SUMMARY

Delhivery shares ended 2023 with gains of about 16%, much lower compared to the returns given by its listed new-age tech stock peers

While the stock remained volatile throughout the year, it slumped after the release of the logistics unicorn’s Q2 FY24 earnings as they missed the Street’s estimates

While most of the brokerages are positive on Delhivery because of its strong growth potential for the long term, the startups faces some risks in the near to medium term

In a year which saw shares of new-age tech startups like Zomato, PB Fintech, and RateGain make big gains, the performance of Delhivery remained lacklustre on the stock exchanges.

Though the shares of the logistics unicorn surged between April and September this year, they are set to end 2023 with much lower gains compared to its new-age tech peers.

It is pertinent to note that Delhivery went for its IPO in 2022 when the number of listings of new-age tech startups fell to a mere three amid tumultuous market conditions. After its listing in May, Delhivery shares slumped almost 40% in 2022, in line with the wealth erosion seen in most of the listed startup stocks.

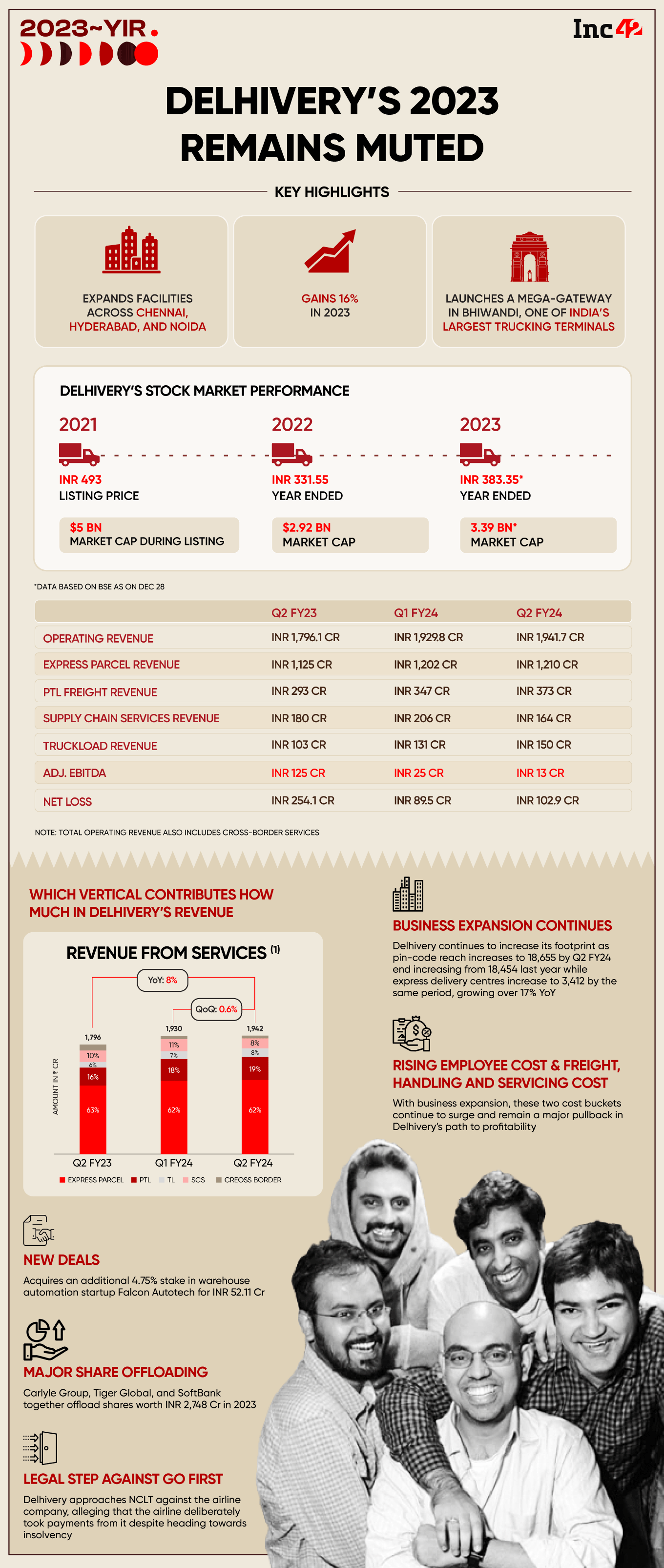

The beginning of 2023 was also not too great for Delhivery as its shares traded sideways till the end of April. However, the stock gained momentum after that and was up 38% year to date (YTD) by September. But this upsurge didn’t last long as the shares shed some of the gains. As of December 28, the startup’s shares were trading about 16% higher YTD.

Slow business growth and rising expenses are seen among the key reasons holding back the stock. The startup’s losses have also not helped the stock as investors are focussing on companies which are profitable or, at least, have a strong profitability outlook.

With that said, let’s take a look at Delhivery’s 2023.

Delhivery’s Volatile 2023

Shares of Delhivery remained volatile this year, but its earnings estimates’ miss in Q2 FY24 led to a bigger slump.

Delhivery reported its Q2 FY24 financial results on November 4, posting a 90% year-on-year (YoY) decline in adjusted EBITDA loss to INR 13 Cr, while its net loss narrowed almost 60% YoY to INR 102.9 Cr.

Meanwhile, operating revenue increased a mere 8% YoY to INR 1,941.7 Cr. The shift of festive season sales to Q3 this year also played a role in this.

However, most brokerages expected the company to report a larger decline in loss and higher sales. The logistics startup’s growing expenses due to investments for growing its capacity and expansion hurt its bottom line.

Delhivery’s express parcel business, which accounted for the biggest chunk of operating revenue during the quarter, failed to increase its contribution to the overall business on a YoY basis. Meanwhile, revenue generated by the express parcel and part truckload (PTL) verticals continued to witness growth, while the growth of the supply chain services business slumped.

There were several other developments, which impacted the stock’s performance positively as well as negatively in 2023.

Key Developments In 2023

- Delhivery expanded its facilities across Chennai, Hyderabad, and Noida

- Launched a mega-gateway in Bhiwandi, one of India’s largest trucking terminals

- Acquired an additional 4.75% stake in warehouse automation startup Falcon Autotech for INR 52.11 Cr

- Claimed to be “almost at the breakeven point”

- Moved to the National Company Law Tribunal (NCLT) against Go First alleging that the airline deliberately took payments from it despite heading towards insolvency

The exit of some of its pre-IPO investors also had an impact on the stock performance during the year.

Delhivery’s Shareholding Pattern

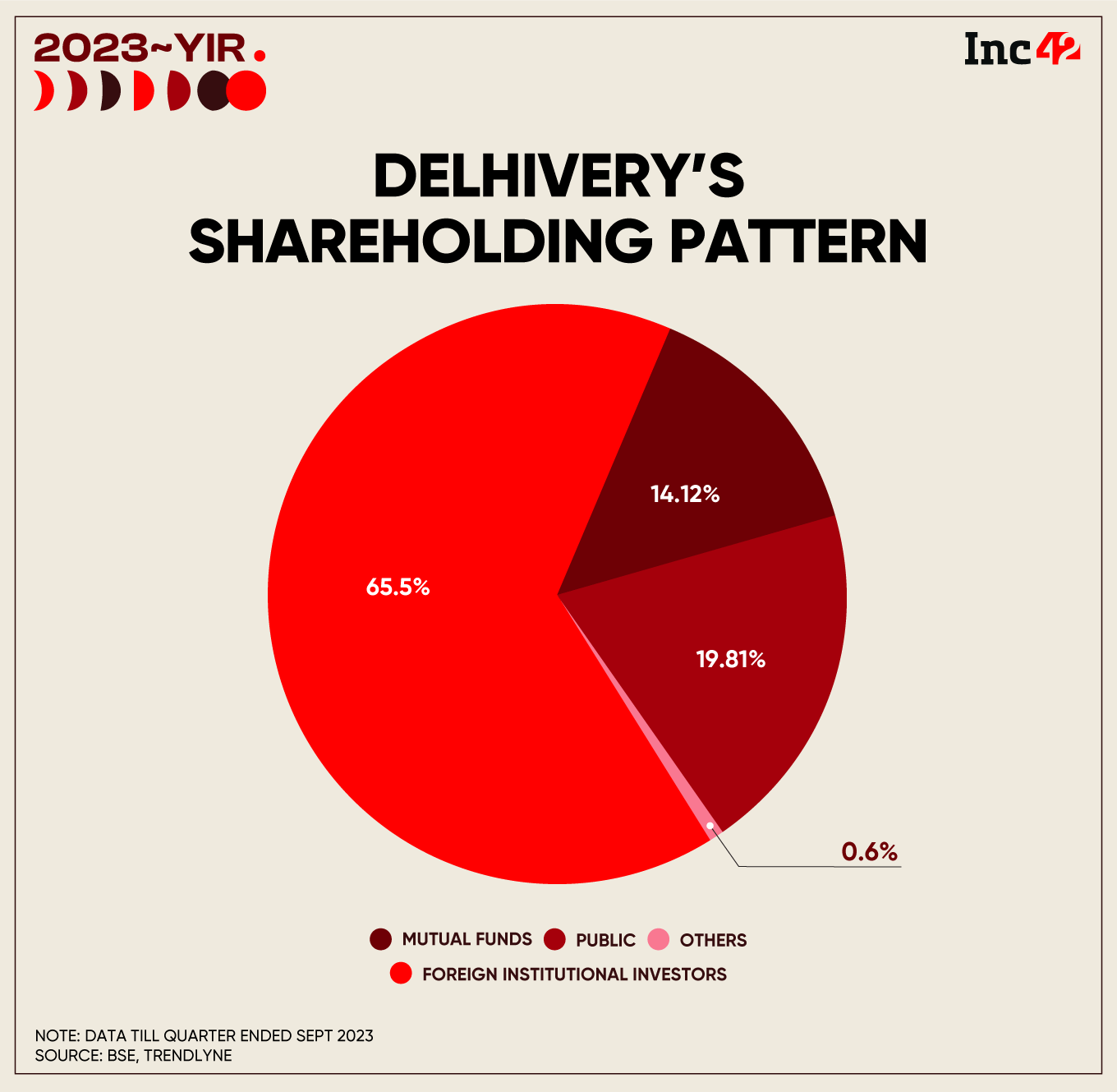

In a trend similar to the one seen in other new-age tech stocks, Delhivery witnessed large block deals and major exits during the year.

- Private equity firm Carlyle Group offloaded its remaining 2.5% stake in Delhivery in June via bulk deals worth over INR 709 Cr

- VC major Tiger Global offloaded its 1.6% stake in Delhivery in a bulk deal for INR 338 Cr

- SoftBank dumped over 6.3% stake in Delhivery during the year in deals cumulatively worth INR 1,701 Cr

The stake held by foreign investors in the logistics startup also saw a decline throughout the year. Foreign institutional investors (FIIs) held a 65.5% stake in Delhivery at the end of the September quarter of 2023 against a 74.24% stake a year ago.

Meanwhile, mutual funds increased their cumulative stake in the startup. As of September 2023, as many as 16 mutual funds held a 14.12% stake in Delhivery against 13 funds holding a 6.95% stake a year ago.

Will Delhivery Deliver In 2024?

The Delhivery stock is currently trading below its listing price at around INR 380.

Of the 23 analysts covering the stock, 16 have a ‘buy’ or higher rating on it while five have a ‘hold’ rating. Its average price target is INR 452.17.

Analysts largely believe that the stock has strong growth potential for the long term. However, rising competition and increasing expenses remain the key concerns in the near to medium term.

For instance, international brokerage UBS recently initiated coverage on Delhivery with a ‘buy’ rating, citing long-term synergistic growth and profitability potential. However, it flagged increasing competition and customer concentration as key risks.

Meanwhile, ICICI Securities, in a recent research note, said Delhivery’s adjusted EBITDA profitability could see a reversion on a sustained basis given that ecommerce shipment volumes are trending upwards again after a slow year.

However, the brokerage believes that if medium-term growth visibility worsens due to global headwinds, it could pose a risk to the growth thesis.

On the technical charts, the stock is showing signs of a 10-20% correction in the medium term, according to Kush Ghodasara, CMT and an independent market expert. He believes the stock will take a long time to script a turnaround.

With geopolitical tensions like the Red Sea attacks emerging as another threat, it remains to be seen if Delhivery can deliver better returns to its investors in the coming year.