SUMMARY

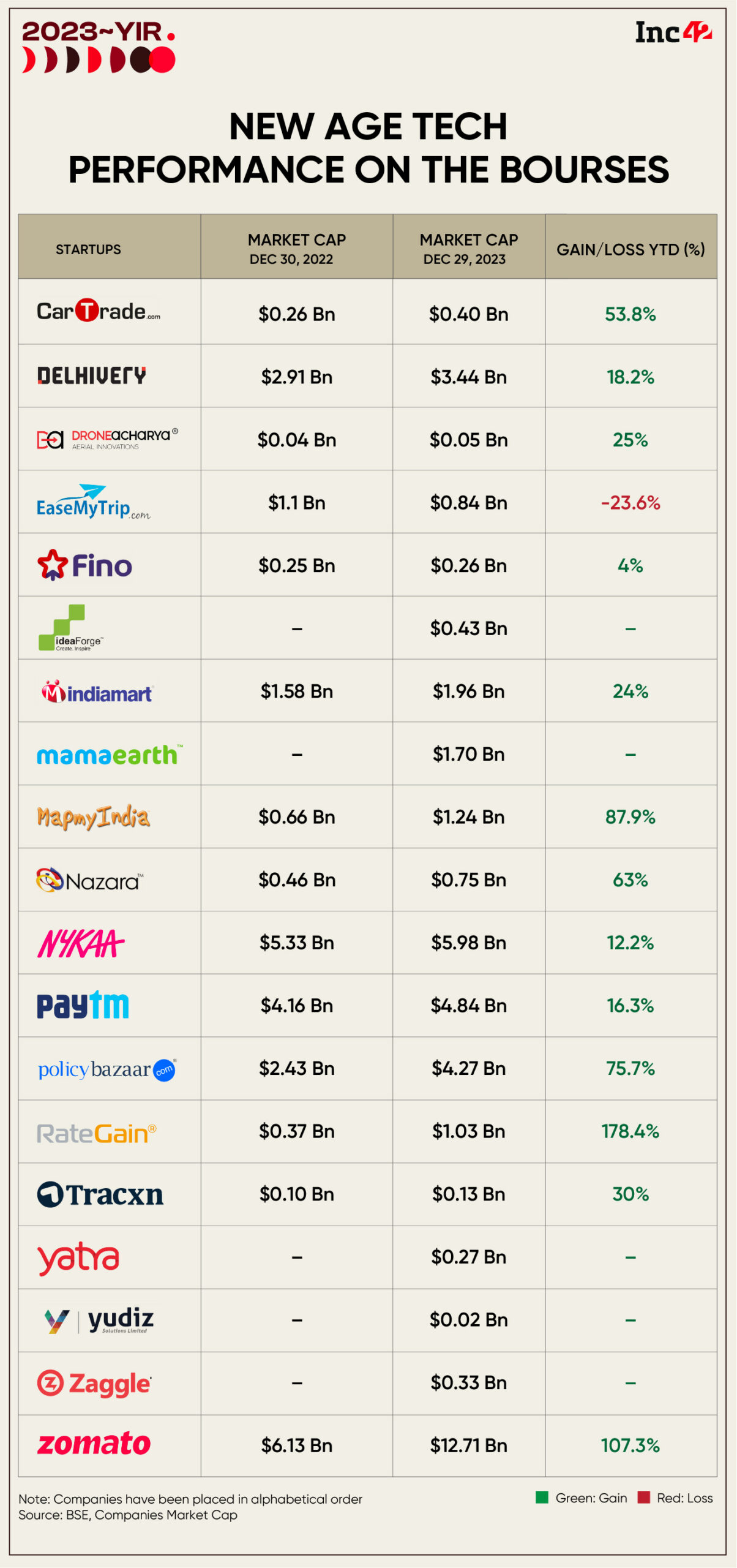

The combined market capitalisation of 14 Indian new-age stocks that were under Inc42’s coverage in 2022 surged to $36.9 Bn at the end of 2023 from $25.07 Bn a year ago

Overall, by the end of 2023, the market cap of 19 new-age tech stocks currently under Inc42’s coverage stood at $40.6 Bn

The five debutants – ideaForge, Mamaearth, Yatra, Zaggle, and Yudiz – ended their first year on the exchanges with a cumulative valuation of $3 Bn

The improvement in the global macroeconomic environment and change in investor sentiment on the back of improving financials turned 2023 into a bumper year for listed new-age tech startups after a forgettable 2022.

The 14 Indian new-age stocks that were under Inc42’s coverage at the end of 2022 together gained $11.8 Bn in 2023. Their combined market capitalisation stood at $36.9 Bn at the end of 2023 as against $25.07 Bn a year ago.

Among these, two of the biggest gainers were Zomato and RateGain, whose shares jumped over 100% in a year.

It is important to note that the 11 Indian new-age tech stocks under Inc42’s coverage at the end of 2021 – Nykaa, Nazara, Zomato, Paytm, PB Fintech, CarTrade, Fino Payments Bank, IndiaMart, EaseMyTrip, and MapmyIndia – together shed over $30 Bn in total market capitalisation in 2022.

Meanwhile, EaseMyTrip, which was the only 2021 listing that did well in 2022, became the only loser this year, with a sharp correction of over 23% in its market value.

Overall, by the end of 2023, the market cap of 19 new-age tech stocks currently under Inc42’s coverage stood at $40.6 Bn.

Here’s a year-on-year comparison of the market cap of the 19 listed new-age tech startups under Inc42’s coverage.

The Dazzlers Of 2023

While the year was an exceptional one for most new-age tech stocks, some of them stood out as improvement in their business performance, bottom lines, and sectoral trends gave them a boost.

Zomato Delights Investors

Foodtech giant Zomato turned its fortunes on the stock exchanges in 2023. Its market capitalisation, which nosedived over 60% in 2022 to $6 Bn, rebounded strongly to end this year at $12 Bn.

Zomato’s two consecutive profitable quarters, Q1 and Q2 of FY24, proved to be the ultimate game changer for the stock that was already on an uptrend since the beginning of the year due to its business decisions.

From reintroducing the Zomato Gold loyalty program to the introduction of a platform fee, Zomato’s new monetisation avenues boosted its fundamentals during the year.

Zomato also became a leading force in changing the overall market sentiment towards the new-age tech startup in 2023.

Shares of Zomato surpassed INR 125 level on the BSE, surging 108% year to date (YTD).

RateGain Takes Off On Travel Market Boom

Traveltech SaaS startup RateGain was another 2021 listing that saw a lacklustre 2022. However, it declined below 20%, which was lower compared to the likes of Zomato, Paytm, PB Fintech, and others.

However, RateGain turned out to be the biggest gainer among these shares in 2023, rising a whopping 160% YTD.

From a market cap of $0.37 Bn at the end of 2022, RateGain’s valuation surpassed $1 Bn mark by the end of December this year.

RateGain cashed on the sharp growth in the travel industry post-Covid, with more and more players opting for digitalisation. Its profit kept leapfrogging every quarter this year.

PB Fintech’s Phenomenal Year

The fintech major was one of the biggest gainers in 2023 as its bottom line improved and there were no new regulatory hurdles to challenge its growth.

PB Fintech’s market cap more than doubled to $4.2 Bn by the end of 2023 from $2 Bn at the end of 2022. Its shares also gained over 75% in 2023 in sharp contrast to almost a 50% decline last year.

Though competition remained an overhang, the parent entity of insurtech major Policybazaar and lending tech platform Paisabaaar, kept the investors’ hopes steady with a proper profitability trajectory and showing results ahead of estimates.

Nazara Plays It Well

Despite the GST Council’s decision to hike the GST rate to 28% from 18% hitting the online gaming industry hard, Nazara Technologies delivered a solid performance in 2023.

The company’s shares gained over 47% YTD while its market cap surged to $0.75 Bn from $0.46 Bn at the end of 2022.

The limited contribution of skill-based real-money gaming to Nazara’s overall revenue turned out to be a boon. Nazara shares gained as the company posted steady profit and aggressive expansion plans.

DroneAcharya’s & MapmyIndia’s Bull Run

Drone startup DroneAcharya listed on the BSE SME platform towards the end of 2022 amid strong volatility in the market. The stock gained almost 40% this year, helped by the company signing new contracts, diversifying into drone manufacturing, and cracking multiple other deals.

On the other hand, geotech startup MapMyIndia’s shares also surged over 88% YTD, with its valuation crossing the $1 Bn mark this year. We must note that the homegrown competitor of Google Maps doubled down on its fights against the monopoly that the US-based tech giant created in India.

The Odd Ones Out

Paytm, Nykaa, and Delhivery are three major names that saw an extremely volatile 2023 and ended the year with lower gains compared to their peers.

Shares of fintech major Paytm rallied over 80% until October this year but regulatory changes came as the biggest blow. Meanwhile, Nykaa and Delhivery failed to keep the market upbeat due to a lack of consistent growth.

From a market cap of $4.2 Bn at the end of 2022, Paytm’s valuation surpassed the $7.5 Bn mark in October but now it’s about to end 2023 at around $5 Bn market cap.

On the other hand, Nykaa and Delhivery saw relatively lower rises in their market caps. While shares of Nykaa ended the year 12% higher, those of Delhivery gained 16% in 2023.

The New Entrants’ Mixed Performance

A total of five new-age tech startups – ideaForge, Mamaearth, Yatra, Zaggle, and Yudiz – got listed on the bourses in 2023, with Yudiz listing on the SME platform and the rest on the mainboard.

Together, the five stocks ended the year with a total market cap of about $3 Bn. While the shares of ideaForge and Yudiz have declined since their listing, the others are trading higher.

Mamaearth, which was the most-talked about startup IPO of 2023, has the highest valuation of $1.6 Bn among these five stocks which went public this year.

Will The Gains Continue In 2024?

The Street expects the turnaround seen in the Indian public markets in 2023 to continue in 2024 as well. Most of the analysts are largely bullish on the new-age tech stocks.

While the likes of Nykaa, Paytm, and Delhivery are expected to witness pressure in the medium term, their long-term growth potential looks positive, as per the analysts’ estimates.

However, it goes without saying that the fundamentals of the companies will play the biggest role in deciding the future. Several analysts told Inc42 recently that after the bloodbath in 2022, especially among the IPOs about which there was a lot of hype, the market will continue to remain cautious on IPO valuations and the companies’ bottom lines.

Meanwhile, amid the bloom in the public market, at least 12 new-age tech startups are expected to get listed on the bourses next year.

While geopolitical tensions and high interest rates in the US continue to pose challenges, experts believe that the chances of a downtrend in the broader market are very remote in the near term and this will also support the market performance of the new-age tech startups.

[Edited By Vinaykumar Rai]