SUMMARY

Excluding the borrowing costs, Servify’s net loss increased about 16% to INR 229 Cr in FY23 from INR 198 Cr in FY22

Operating revenue almost doubled to INR 313 Cr during the year under review from INR 611.2 Cr in FY22

Founded in 2015, Servify operates across three continents and its offerings include device protection, product buybacks, and device exchange

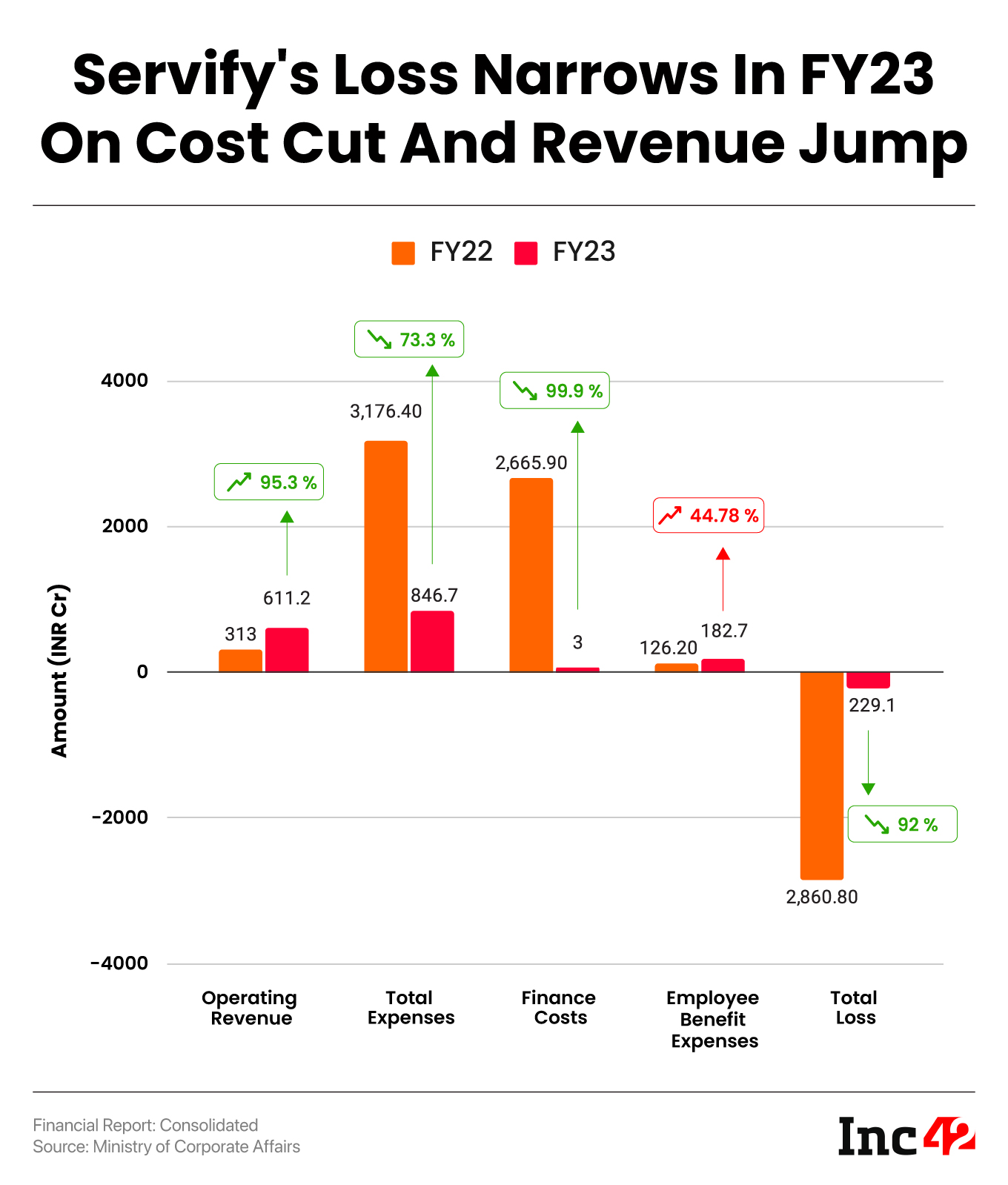

Device management startup Servify’s net loss narrowed to INR 229.1 Cr in the financial year 2022-23 (FY23) from INR 2,860.8 Cr posted in the previous fiscal, helped by a sharp decline in non-operating expenses.

Besides, Servify’s operating revenue almost doubled to INR 313 Cr during the year under review from INR 611.2 Cr in FY22.

Founded in 2015 by Sreevathsa Prabhakar, Servify’s offerings include device protection, product buybacks, and device exchange. The startup earns a majority of its revenue from sale of services, including sale of device protection plans and platform licenses.

In FY23, the startup’s income from sale of services increased to INR 556.3 Cr from INR 267.5 Cr a year ago. Revenue from sale of products rose 20.6% year-on-year (YoY) to INR 54.9 Cr in FY23.

Servify operates across three continents with regional offices in the US, Canada, China, the Middle East, and Europe. Among these, India continues to be the biggest source of revenue for the startup.

It earned INR 382.2 Cr from India, with more than 85% of it coming from sale of services. The US was the second-biggest market, generating revenue of INR 213 Cr in FY23.

Europe contributed INR 5.3 Cr to its revenue, while the number stood at INR 6.7 Cr for the UAE. Canada contributed the lowest to Servify’s revenue at INR 19.56 Lakh.

Interestingly, all the regions witnessed a YoY growth in sales.

Overall, including interest income and other non-operating income, Servify’s total revenue stood at INR 613.4 Cr in FY23 as against INR 315.2 Cr in the prior year.

Servify’s Expenses Plunge

The startup reported an over 73% decline in its total expenses to INR 846.7 Cr in FY23 from INR 3,176.4 Cr the previous year.

Finance Cost: The sharp fall in expenses was led by an almost 100% decline in Servify’s finance cost which stood at INR 3 Cr in the reported year as against INR 2,665.9 Cr in FY22. Within this, other borrowing costs declined to INR 26.29 Lakh in FY23 from INR 2,662.94 Cr in the previous fiscal year.

Other borrowing costs is a non-operating expense referring to fair value of loss on financial instruments.

Excluding the borrowing costs, Servify’s net loss increased about 16% to INR 229 Cr in FY23 from INR 198 Cr in FY22.

Employee Cost: Servify managed to lower its total expenses even as its employee benefit expenses shot up almost 45% to INR 182.7 Cr in FY23 from INR 126.2 Cr in the prior fiscal.

In that, the startup’s salaries and wages rose 43.5% YoY to INR 141 Cr. Its employee share based payment (equity settled) also increased 33.8% YoY to INR 28.5 Cr in FY23.

Cost of Materials Consumed: Meanwhile, the startup’s direct operating cost in the form of cost of materials consumed shot up more than 95% to INR 495 Cr in FY23 from INR 253.7 Cr a year ago, with underwriting and servicing expenses comprising the largest portion of it.

Servify spent INR 345.9 Cr as underwriting and servicing expenses, which jumped 125% YoY.

Its commission expense also increased 52.2% YoY to INR 116.4 Cr in FY23.

Other heads in this expense bucket included protection plan purchases, subvention charges, courier charges, and service and upcountry charges.

Legal Professional Charges: Servify spent INR 22 Cr towards legal professional charges in FY23, which increased from INR 21.6 Cr in the previous year.

IT Expenses: Servify’s IT expenses zoomed almost 68% YoY to INR 13.7 Cr in FY23.

Servify is backed by the likes of BEENEXT, Blume Ventures, and DMI Sparkle Fund, among others. Earlier this year, the startup acquired AI-enabled engagement platform Jubi.ai in a cash and equity deal.

It last raised funding in August 2022, when it bagged $65 Mn as part of its Series D funding round led by Singularity Growth Opportunity Fund.