SUMMARY

The CarDekho group launched its digital lending platform Rupyy to ensure that loans for used and new cars, two-wheelers and EVs are easily accessible and affordable

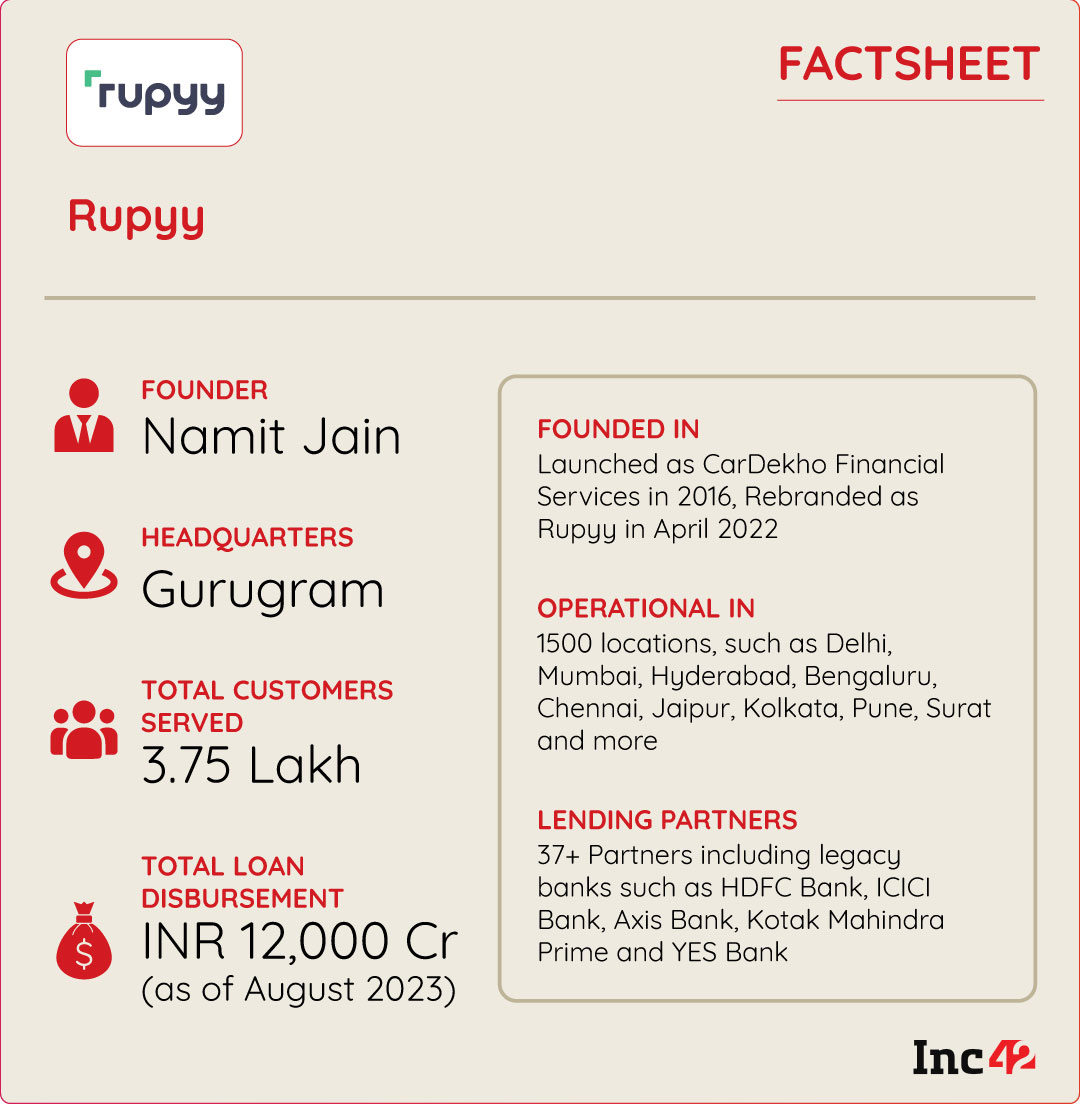

As of August 2023, Rupyy claimed an annualised run rate of INR 12,000 Cr (in loan disbursement) and an 88% year-on-year increase in revenue

Rupyy’s Namit Jain said that the brand clocked an annualised customer base of 2 Lakh customers in August 2023

The auto financing landscape is driving a wealth of opportunities at home and abroad, thanks to the rise in vehicle demand and tech-powered business models. Of late, a growing number of lenders have shown interest in this consumer asset class propelled by online marketplaces, innovative loan service platforms, robust analytics (to determine creditworthiness) and rapidly growing dealership networks, increasing customer stickiness by assuring them auto loans.

Globally, the market for car loans is projected to grow at a CAGR of 6.5% to reach more than $385 Bn by 2028, per a report published by Fortune Business Insights. But car ownership is still significantly low in India – only 8% of Indian families or one in 12 Indian households own four-wheelers.

This is not likely to deter the overall growth of the auto loan segment, as used car financing has become popular among cost-conscious or first-time buyers, especially from Tier II and III cities. The market is growing at a fast clip, given many lucrative options such as zero down payment, attractive interest rates and flexible repayments. In fact, the used-to-new car ratio may reach 1.9 by FY27 and the number of pre-owned units in circulation may surpass 8 Mn by FY27, per a report jointly published by IndianBlueBook and Das WeltAuto.

To ensure that loans for used and new cars, two-wheelers and electric vehicles (EVs) are accessible and affordable throughout the country, digital lending platform Rupyy was launched in April 2022 by CarDekho, a unicorn that has consolidated its position as a reliable marketplace for new and used cars and other personal vehicles. Rupyy also offers personal loans and loans against cars, but unlike many lending tech startups, it has a long backstory.

CarDekho’s financial arm was set up in 2016 to service India’s steadily growing auto loan market. During the Covid-19 pandemic, the autotech group took note of the rollicking party witnessed by the used vehicle segment (buying one was a surefire way to stay off public transportation and health risks) and anticipated a long-term spike in demand across India, especially in non-metro regions. Also, CarDekho’s parent company, Girnar Software, obtained an NBFC licence in 2022

Interestingly, the bet was not so much on the pandemic boost, which would cool off in time, but a deep dive into India’s rising socio-economic aspirations to own personal vehicles. Therefore, an end-to-end digital lending platform was built to connect buyers, dealers (deemed as owners of the vehicles in their respective inventories) and lenders (banks and other FIs), aligning hassle-free financing options with one’s budget and requirements and providing superior customer support.

CarDekho Financial Services (CDFS) has merged with Rupyy to create an efficient ecosystem that covers the entire loan process – from application to approval to quick disbursal. The group’s NBFC arm also lends from its books, providing automotive loans to individuals and short-term financing to car dealers for acquiring inventories.

Speaking to Inc42, Rupyy founder Namit Jain said that the platform has tied up with car dealers hailing from 90% of India’s pin codes and onboarded more than 37 lending partners such as HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra and YES Bank. It claims to have a strong presence in more than 1500 locations, including Delhi, Mumbai, Hyderabad, Bengaluru, Chennai, Jaipur, Kolkata, Pune, Surat, Coimbatore, Chandigarh, Kochi and more.

As of August 2023, Rupyy claimed an annualised run rate of disbursement of INR 12,000 Cr loans and served an annualised customer base of 2 Lakh+ customers. Jain did not reveal the numbers but said that Rupyy’s revenue soared by 88% YoY and its customer base increased by 82% in the same time.

The Rupyy Blueprint For Loans

“Before 2016, securing a loan to purchase a used car was a rare occurrence in India. Only two to three out of every 100 used cars were sold with financing plans,” recalled Jain.

Rupyy was set up to address the need for a targeted solution, especially as the market for used car financing was largely fragmented and dominated by unorganised players.

The leadership team at the erstwhile CarDekho Financial Services had already ventured into that space with a similar vision and tasted success. It was introduced to bring convenience and transparency to automobile loans when individuals buy pre-owned vehicles. But what started as a modest project soon evolved into a major business in the vehicle financing space. With further rebranding and reinforcements in place for Rupyy’s launch, the combined team has taken its efforts to the next level.

“Rupyy is committed to removing all traditional barriers across automobile financing. We offer a platform that is as accessible in bustling metros like Delhi as in quieter, semi-rural areas of Kerala,” said Jain.

According to CarDekho, CDFS had a monthly run rate (MRR) of INR 400 Cr in used car loan disbursements at the time of Rupyy’s launch and an annualised run rate of INR 5K Cr in total loan disbursements in FY22.

In the past 19 months, Rupyy has expanded its loan offerings beyond the used car segment and explored new verticals. After successful pilots in new car financing in FY22, the platform has turned it into a full-fledged category and also entered other segments like two-wheeler loans.

As a financial product distributor, Rupyy gets a commission from lending partners on every loan disbursed through its platform. According to Jain, the used car loan vertical is the most popular now, accounting for 91% of Rupyy’s revenue in FY23.

To secure a loan from Rupyy, customers can apply on its website providing necessary documents like income proof and ID. They are then required to complete video KYC and sign the digital loan agreement. Rupyy partners with major banks, providing up to 90% of the asset’s value as a loan and subsequently, customers receive the money in your bank within 48 hours. In addition, Rupyy handles the transfer of ownership papers to the new owner through the regional transport office (RTO).

Riding on the tech wave, the brand had also launched a QR code-based onboarding system built on a microservices architecture (needed for developing and deploying a collection of services for ease of use). This solution helps users scan a QR code at any partner dealership and apply for a loan. Rupyy also uses AI/ML algorithms to automate document verification.

How Rupyy Navigated Speed Bumps To Carve A Niche

The car financing landscape has undergone a remarkable transformation in terms of scale and convenience, thanks to a strong focus on digitalisation. But ask Jain about the initial hurdles, and he would say it was not a large enough market at first.

“As finance penetration was less than 3% in the pre-owned car segment, there wasn’t a slice of the pie to grab [in that niche space]. A whole new pie had to be baked,” he said.

Add to that a host of incumbents dominating the market – the likes of CARS24 Financial Services (a wholly owned subsidiary of the used car marketplace CARS24) and legacy players, including Mahindra Finance, the State Bank of India, Bajaj Finserv and Tata Capital. Undoubtedly, it was difficult for CDFS and its successor, Rupyy, to carve a niche.

But the biggest hurdle is the risk-averseness of lenders, as rising credit card and car loan defaults are hitting even developed economies like the US. In India, too, credit card dues surpassed INR 2 Lakh Cr in April this year, while outstanding personal loans increased by 20% in FY23 (INR 40 lakh Cr in February 2023), driven by vehicle and home loans.

Understandably, banks and other FIs were reluctant to tie up with a new lendingtech platform, although car loans are primarily secured – the automobile being the collateral. However, Rupyy has developed a data-backed asset pricing engine to help its lending partners calculate loan risks more accurately.

The intricacies of title transfer from the seller to the buyer were another critical challenge. The legal obligation lies with the buyer to transfer vehicle registration and pay all relevant fees. But processing these documents requires a lot of time and effort, especially when the parties concerned live in different cities.

Rupyy has built a massive network of agents who cover more than 1,100 RTOs across India to address this issue. The platform has also developed proprietary software to set up a hyperlocal network of car dealers and display the nearest ones to potential buyers. Powered by these initiatives, customers can quickly pick up their vehicle documents and transfer car ownership without hassles.

“Also, our platform gives visibility to small dealers previously overlooked by customers,” said Jain. “This has created a win-win-win situation. Lenders have expanded reach; dealers do more business and consumers have a bigger inventory to choose from.”

Tier II And Beyond Fuelling Pre-Owned Auto Loans, But Will It Be Sustainable?

Rupyy’s primary market research shows that the Indian used car financing market, valued at $ 6.82 Bn, is projected to reach a value of $13 Bn at a CAGR of approximately 24% during the forecast period from FY2024 to FY2027.

“This heightened demand for used car loans is poised to continue its upward trajectory, presenting significant opportunities for us,” said Jain. Rupyy is bullish about the burgeoning market and aims to achieve a 100% YoY revenue growth in FY24.

The platform has an ambitious growth plan of expanding its geographic coverage up to 97% of pin codes in next three-four quarters. It aims to capture more than 20% market share in the used car loan segment and will also focus on the new car loan category.

As a KPMG report points out, “motor finance is at the crossroads between the automotive and finance sectors”, evolving fast in sync with users’ requirements. With the loan market for used cars getting more organised, powered by the entry of more OEMs, new dealerships and tech-enhanced lending platforms, there will be more traction for certified pre-owned vehicles in India. But the bet on quality and reliability may drive up the price.

Besides, people change cars more frequently nowadays – within three to five years – which means pre-owned cars are usually in good condition and will cost more. Some buyers are also open to pre-owned luxury vehicles due to their features and value for money. Essentially, used car prices are expected to rise as raw material and production costs go up, along with inflation and interest rates.

Will it signify fewer sales in the long run, more loan defaults and neck-and-neck competition among digital lenders keen to leverage a booming yet affordable used car market? Will low-income earners-turned aspirational buyers be compelled to leave due to surging prices?

Industry insiders think there is little risk of a sales crunch just now, as the Indian market for new and used cars is far from saturated. In fact, the latter has significant potential for growth and innovation if it can provide price transparency and ensure an excellent customer journey. More importantly, lending continues to play a critical role in both segments, as 65-75% of the cars in metros and non-metros are now purchased with financing.

That is good news for finance providers like Rupyy who want to grow. Meanwhile, they must understand unique needs, build trust and tailor customer journeys to stand out.